Real Estate Investment

Investment crisis in Germany

Classic investments, from savings accounts to life insurance, no longer generate any interest. Stocks and funds oftenly suffer from high volatility resulting from stock market developments.

The only real alternative – inflation-protected, low-risk but still highly profitable – are real assets, especially real estate.

However, these are not affordable for everyone. Not every investor looking for an investment with permanent potential for value appreciation is capable or willing to acquire suitable real estate by himself.

Investors let their capital work precisely in some of the most profitable real estate segments in Germany without having to become active in the market by themselves or having to raise the total investment for a high-yield real estate object.

Current investment projects

Strengthen your capital with real estate by Unicorn Real Estate GmbH

Unicorn Real Estate GmbH now offers our investors the opportunity to participate in value stocks via small capital investments with comparably small amounts of capital. Investors can benefit from our equally traditional and innovative investment models.

Advantages

Offers for security-oriented investors

- Tailored to individual investor interests

- Hedging by real existing assets

- Occupation of market segments with potential for development

- Competent and trustworthy management

- Attractive yield prospects in times of low interest rates

For comparison

Traditional investments

Investing in Unicorn Real Estate GmbH

Did you know?

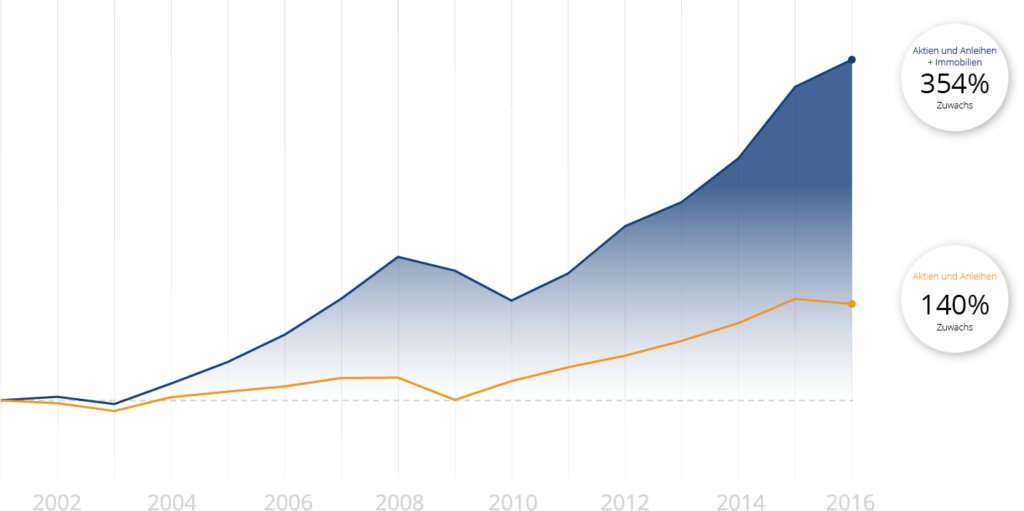

Investors who diversify their assets with real estate achieve a higher return rate than those who don’t.

Fast jeder erfolgreiche Investor hat einen signifikanten Anteil seines Portfolios in Immobilien investiert, teilweise mehr als 20 %. Historisch betrachtet haben diese Investoren jene überholt, die nur in Aktien und Anleihen investiert haben. Mit der Unicorn Real Estate GmbH können Sie jetzt ganz einfach partizipieren. Melden Sie sich einfach, unkompliziert und unverbindlich an!

Profit from the real estate market

Die Unicorn Real Estate GmbH bietet ihren Anlegern und Investoren mit ihren verschiedenen Small-Capital-Beteiligungen die Chance, mit einer sehr konservativen Anlage-Strategie weit überdurchschnittliche Renditen zu erzielen. Sachwerte, Expertenwissen und verantwortungsvolles Wirtschaften der Unicorn Real Estate GmbH sichern Ihre Anlage ab.

Die Unicorn Real Estate Gesellschaft mbH ist ein junges, aber durch die Netzwerkpartner mit mehr als 20 Jahren Erfahrung in der Immobilienbranche und im Bereich der Finanzdienstleistungen ausgestattetes Unternehmen. Unser Fokus liegt auf dem Handel von Immobilien und mobilen Sachwerten, Small-Capital-Beteiligungen, der Bauträgertätigkeit und der Vermittlung von Immobilien an Dritte.

Die Unicorn Real Estate Gesellschaft mbH ist spezialisiert auf den Erwerb, die Entwicklung, das Management und den Verkauf von Wohnimmobilien. Tätigkeitsschwerpunkt sind die liebevolle Sanierung, Aufteilung und Privatisierung hochwertiger Altbauten mit historischer Substanz. Der Erhalt dieses Kulturerbes ist ein Garant für die dauerhaft positive Wertentwicklung der Objekte. Hier agiert die Unicorn Real Estate Gesellschaft mbH als innovativer Projektentwickler und erfolgreicher Immobilienvermarkter.

Die Unicorn Real Estate Gesellschaft mbH “betoniert“ ihr Versprechen an ihre Investoren:

“Our concept of value stands for an ethic of economic responsibility, which puts the thinking about safety above return decisions and allows only for investments in real and solid assets.”

Useful information

Registered bonds, as financial instruments for companies in capital markets law, have a special status as securities-free investments due to the simplified margins of clause exemption from the general prospectus obligation. Registered bonds or bearer bonds as securities, promissory note loans and shareholder loans are contractual agreements in accordance with §§ 488 ff, 793 ff BGB with a right for creditor claim (“money against interest”). Bonds are issued by companies for financing at a fixed annual rate. Therefore, bonds are formalized securities-oriented “loans”. They represent liabilities in the balance sheet and are issued with a fixed interest or a minimum interest plus profit participation (profit-based bonds) for corporate financing on time. Loans, subordinated loans and shareholder loans (profit loans) are not securitized legal relationships like bonds, but informal individual contracts.

How it works

Step 1

Fill out the form. After your request, you will receive actual investment opportunities.

Step 2

Wählen Sie aus den verschiedenen Small-Capital-Beteiligungen die für Sie geeignetste.

Step 3

Senden Sie uns die Unterlagen zurück und profitieren Sie sofort.